March 14, 2019

Analysis: Do AI startups get more VC money?

Author:

CSO & Co-Founder

Reading time:

8 minutes

Introduction

In this study, we’ve analyzed thousands of VC funded companies. The goal was to find out the impact of claiming to use artificial intelligence on the size of funding rounds and the likelihood of hiring an AI consulting company. You will find below a comparison between AI startups and non-AI.

The study is based on the analysis of funding data from sources such as Crunchbase or Angellist. We’ve selected Artificial Intelligence-related startups based on the mentions of AI-related keywords. Such as (AI, machine learning, ML, data science, and artificial intelligence) in their company names, SEO descriptions, social media tags, and social media descriptions.

You might find this article interesting: Data Engineering in Startups: How to Manage Data Effectively

TLDR

- AI startups receive larger seed, A and B rounds – with median round size larger by 53%, 128% and 20% consecutively.

- In Q2 2018 around 30% of VC seed money landed in startups providing AI solutions

- Since the beginning of 2017, the quarterly number of A and B rounds of AI startups both went up by 150%

- California is home to half of all US VC funded AI companies but only 25% of active AI job listings.

Comparison of round size between AI and non-AI startups

In this part of the analysis, we took under consideration US startups that have received funding of the given type since the beginning of January 2017. We compare AI related startups with non-AI related startups.

1. Seed round

The graph shows the probability of a company receiving funding of a given size. It’s depending on whether or not they market themselves as using AI. For data consistency, we took under consideration US companies below 500 employees. Ones, that received the seed round since the beginning of 2017.

As you can see, AI companies clearly dominate $2-$5M range while non-ai startups raise more $100-500k seed rounds. When calculating range-based average funding, it turns out, AI startups receive 28% higher average seed rounds than their non-ai based peers. ($1.6M vs $1.25M).

Medians

Let’s take a look at their medians. Out of a total of 493 US AI startups, half have received more than $1M. In comparison, in the non-ai group, the median was equal to $650K.

You might find it odd that the medians in this study are lower than in other popular publications. The differences are caused by the fact that we use data from websites such as Crunchbase or Angellist. They include the seed round values declared by the founder – not the ones provided by funds.

This means we take into account FFF and self-funding rounds as long as they are presented as seeds by CEOs. At the same time, most analyses are based on official VC rounds.

If you’d like to know how they perform when we don’t count deals smaller than $100k. We’d still land with $1M for non-AI and $1.35M for AI startups.

Olin Hyde, CEO & Founder of LeadCrunch.ai:

The best advantage for A.I. startups is to think so differently about a universal problem that they develop a new business model that leverages the power of data. Few VCs are brave enough to think so differently. This explains the overinvestment into algorithms using old business models (such as SaaS) and the underinvestment into new business models that focus on data advantages.

2. Series A

These groups seemingly look quite similar. Small differences such as domination of AI startups in $5-$25M deals. A slightly smaller presence in $1-5M and $25-40M ranges. However, the key statistic that is not shown here is the distribution of deals within the $5-10M group. It’s the source of huge differences in the median deal.

The median for AI startups is $16M. It doesn’t sound impressive unless you learn that for non-AI startups it’s only $7M.

Explanation

One explanation of this phenomenon could be that AI startups are a lot riskier in the early stages of development. As the investor, you never really know how impactful the technology could become. This lowers valuations at earlier rounds but as the startup delivers the product to the market this effect is no longer valid which leads to a lot bigger valuations.

Another explanation could be that A-series AI startups have to hire expensive researchers to deliver a valuable product and thus have to give away a larger portion of their shares.

As Andriel Bercow from Flybridge Capital Partners puts it:

With AI expected to contribute $16 trillion to the world economy over the next 10+ years, I believe we’re still in the early innings of investing in AI-powered companies. There are a number of reasons for this. One, there are incredible potential applications for AI to impact the way we live and work through new features, augmenting human, and autonomous systems. Two, from a VC perspective, we’ve seen AI startup acquisitions increase by 600% over the last 4-5 years as tech giants like Google, Facebook, and Apple increase their activity.

3. Series B

In the case of series B rounds, we can see the clear domination of AI startups in larger deals. In this case, they dominate the $10-50M deals. Non-ai startups are a lot more likely to receive less than $10M.

When taking under consideration deals smaller than $50M, we land with AI companies receiving 14% larger deals. ($20M vs $17.4M)

The difference of medians is also significant though not as much as in the case of series A deals. $18M for AI startups and $15M for non AI startups – 20% difference

Sumeet Shah – VC Specialist

Artificial Intelligence is definitely feeling a bit like a buzzword these days, but there’s a real reason why investors are pushing hard into it. When appropriately used, AI can efficiently manage a lot of the internal process steps and not tie the user up in any confusing bugs, allowing the ultimate product’s features to shine only to the user. [..] I wouldn’t be surprised to see more deeper investment, especially if Series A startups (where traction on product and user growth is quite notable) have rocketed over 125%.

Trends in the number of AI startups rounds by quarter

1. General trends for AI startups

In this part of the report, we take a look at the number of VC deals signed by AI and non-AI startups. The graph above takes into consideration the summed up number of Seed, A and B rounds all around the world. 100% is the value as of Q1 2017.

As we can see the number of non-AI deals stays pretty much unchanged while we’ve seen a 72% increase in AI deals.

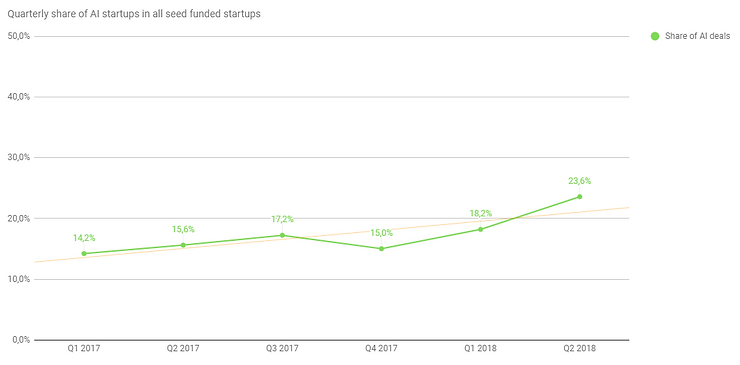

2. Seed rounds

The graph contains the number of All seed rounds and all Artificial Intelligence startups seed rounds since the beginning of 2017.

The stats don’t look very impressive unless you take a look at the raw data. The number of AI-related startups raising seed rounds has increased from 198 in Q1 2017 to 284 exactly one year later. That’s a 43% spike in a single year.

The share of AI startups in all funded startups went from 14.23% to 23.59%. That’s a 66% spike in just 18 months.

Considering the fact, that the average seed round of an AI startup is bigger by 28%, it turns out that 30,2% of all the seed money landed in AI startups.

3. Series A

The number of series A rounds of AI startups went from 51 to 127 in just 18 months. A whopping 149% increase.

The share of AI deals went from 12,69% in Q1 2017 up to 24,85% in Q2 2018. Strong, almost 100% increase.

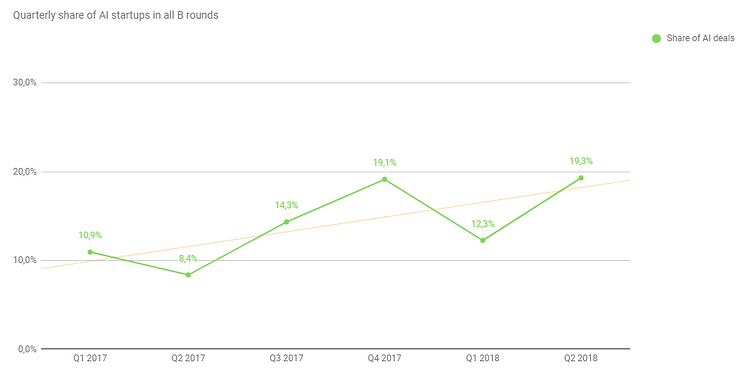

4. Series B

The number of series B rounds in AI segment went from 22 in Q1 2017 up to 55 in Q2 2018. 150% spike within 18 months.

Within a year – from Q2 2017 to Q2 2018 the share of AI companies’ deals in all series B rounds went from 11,13% to 25,67%. Increase by 131%.

AI startups funding and jobs by state

It’s no surprise that California hosts almost twice as many financed AI startups as the bottom 40 states combined. Almost half of all financed AI startups in the country.

However, it’s interesting to compare the data of company HQ with actual job listings for AI-related positions.

Let’s take a look at them (As of 09/09/2018):

As you can see California is still at the top of the list, but this time not by that far. As it turns out, even though California is home to almost 50% of all funded AI companies, it is only home to 32% of active AI employers and 26% of AI job postings from companies of the same profile.

This statistic might suggest that a large part of AI companies with HQ in silicon valley actually have their R&D centers spread across the country/world or simply outsource.

With AI researchers’ wages reaching an all-time high, it’s no wonder more and more companies would rather spend their VC money in other regions.

About us

Addepto is an AI consulting company that delivers custom, advanced machine learning for startups in the US and Europe. Alex Bedlitsky is a business consultant helping startups find opportunities to multiply their product’s impact using AI. If moving into AI is something you’re thinking about, you can get an estimate for your idea here.

Category: