February 15, 2021

Python for Finance: How is it used?

Author:

CSO & Co-Founder

Reading time:

12 minutes

The TowardsDataScience.com portal called Python one of the “top in-demand programming languages to learn”[1]. Without a doubt, it’s an accurate opinion. Python offers many significant advantages and is simply pleasant to work with. That’s why many programming beginners start their IT adventure with this language. But Python for finance? Is that a good idea? We believe so. Python in finance is really a good idea, and today, we are going to show you why. In this article, we will concentrate on financial modeling in Python, but also on how Python is used in finance. Let’s get right to it!

Since that’s the very first time we are going to talk about a specific programming language, let’s focus on what Python is.

Python for finance: Basics

Python came into existence in the 1990s. Initially, it was one of Guido van Rossum’s side projects. At that time, no one would say that this “side project” will rise to be one of the most popular programming languages ever.

The main reason why this language has gained such incredible popularity is that, from the very beginning, the main idea behind Python was to create a language that would lower the barrier to programming. Python was always supposed to be a programming language that’s entirely focused on the developer’s experience. It was supposed to be so straightforward so that even school kids could learn it and write fully-fledged code and applications. Indeed, Python was destined for greatness.

Today, as we can read on Python’s website, this language is an interactive, object-oriented programming solution that comprises all the relevant elements:

- Modules

- Exceptions

- Dynamic typing

- High-level dynamic data types

- Classes

Python comes in handy in many different programming paradigms, just to mention object-oriented programming, procedural programming, and functional programming. What’s also worth noting is Python combines amazing power with very clear syntax (remember? Simplicity was crucial from day one).

In fact, Python is based on English-like syntax, which makes it much easier to read and understand the code. With this simplicity comes another benefit. Developers can focus on solving the problem, not learning the code. You don’t have to spend too much time trying to understand the syntax or behavior of this language.

Additionally, Python offers interfaces that support many system calls and libraries, as well as various window systems.

Although it’s a fully-fledged standalone programming language, Python is easily extensible in C or C++.

You can also use it as an extension language for your applications that need a flexible, fully-programmable interface.

Key Python features

Although Python comes with many different advantages and features, there are three features that distinguish this programming language and are worth noting:

- One of the most significant advantages of Python is its language design. On the one hand, it is highly productive and powerful, and on the other hand–still elegant and simple to learn and use.

- Python has first-class integration with C/C++ and can be used on devices running on both Linux and Windows.

- Python has a very active community and tech support.

What about other advantages of this programming language? Well, Python makes a case for itself, especially when you:

- Need a general-purpose language that can be easily used to deal with different classes of problems

- Look for a solution that offers a large standard library that comprises string processing, internet protocols, software engineering, and operating system interfaces

- Prefer interpreted languages. A word of explanation: Interpreted languages execute the code directly line by line. If an error occurs, Python automatically stops further execution and reports back the error. It’s a tremendous work simplification that makes debugging much easier.

- Need fewer lines of code to perform a given task. When compared to other major languages like C/C++ and Java, Python uses much less code. It’s brilliant in its simplicity: You write less code and simply get more things done!

- Want to run your code everywhere. When it comes to most programming languages, just to mention C/C++, you need to change the code before you can run the program on different platforms. With Python, you can only write the code once and freely run it anywhere. Bear in mind that there’s one exception: Remember not to include any system-dependent features.

Also, at this point, we should add that Python is free. According to their website: “You can do anything you want with the source, as long as you leave the copyrights in and display those copyrights in any documentation about Python that you produce”[2].

Python’s disadvantages

Naturally, as it happens with any other IT solution, Python is not flawless. There are a few disadvantages that we should mention:

- Because Python is executed line by line, it can be slow. If it’s the speed you’re looking for, pick another solution.

- Python uses a lot of memory, which in many instances can be a disadvantage

- Python requires thorough testing procedures. That’s because Python is a dynamically typed language, so the data type of a variable can change anytime, which can lead to runtime errors.

Python’s popularity

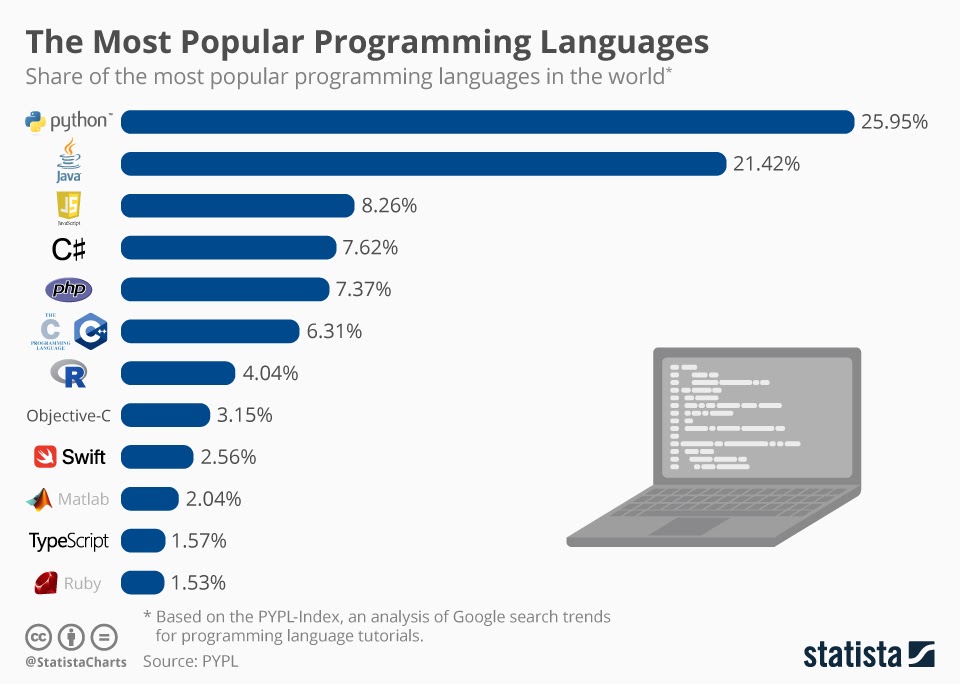

In early 2019, Statista.com[3] published a comparison of the most popular programming languages in the world:

Python is a clear leader with almost 26% share among the most popular programming languages. And in fact, Python-based solutions can be found almost anywhere in the IT world:

- Applications (for example, Dropbox is a web-based file hosting service built with Python)

- Video games (The Sims 4, Battlefield 2, the list goes on!)

- Web frameworks (Flask, Django, Pyramid…)

- Mathematical libraries (Matplotlib, Plotly), and many more places

And this way, we go back to our main topic–Python in finance. How is python used in finance? And how can it be used in financial analysis and financial modeling?

Python for finance

First of all, let’s think about why Python for finance is a good idea? There are a few reasons:

Python handles many elements automatically

Let’s consider memory management. Many of the lower-level programming languages require a detailed understanding of the complexities of how the computer’s memory is laid out and released, in addition to the time spent and lines of code required to handle tasks. Python handles many of these details automatically. This way, programmers can focus on their goals.

Python connects economics and data science

Economists and data scientists frequently use Python to make their calculations and predictions. With Python, you can easily integrate the work of economists and data scientists into one solution/platform. In fact, it’s Python’s simplicity and flexibility that has won the entire financial sector.

A business-oriented language

If we could say about any programming language that it’s “business-oriented”, it would have to be Python. With Python, you can concentrate on what you want to achieve. Many technical details are in the background, not distracting you from your business purpose. For instance, with Python, you don’t have to use semicolons to delineate functions, loops, and lines the way it happens with other programming languages. This way, you keep everything concise and save time.

Man different purposes

Because Python is so versatile and easy to learn, it can be used in many different financial projects and applications. Moreover, Python is just perfect for prototyping and rapid, iterative development. When working with Python, you can write and execute each line of code in isolation and see the results immediately.

Useful both for prototyping and production

Here’s another vital aspect of Python. It can be easily used both in the prototyping stage and for the production of extensive applications. That’s why many market leaders eagerly use Python in their projects, even large-scale ones. Maybe a couple of examples: Google, Facebook, Instagram, Spotify, Quora, Netflix, Reddit. All of these companies utilize Python in their projects!

Comes with libraries

That’s partly an answer to the question, Why Python programming for finance is so popular? Everything you need is already built into the language. And Python’s extensive library has tools that enable you to accomplish a wide variety of tasks without having to look for any additional third-party packages or libraries.

And when it comes to Python in finance, Pandas (data analysis libraries) with its DataFrame and Series objects, and Numpy (a library adding support for large, multi-dimensional arrays and matrices) with its ndarray are frequently used in financial modeling in Python.

In fact, Python is a great choice for conducting quantitative analysis that refers to financial big data. With libraries such as Pandas, Numpy, SciPy, and other similar modules, you can easily manage huge databases and visualize the results.

All in all, today, Python in finance is one of the leading languages used for quantitative and qualitative analysis. Financial and IT companies use Python for:

- Development of various payment and online banking solutions

- The analysis of the current stock market situation

- Reducing financial risks

- Determining the rate of return of stocks and many other elements.

Financial modeling in Python

Currently, more and more financial and accounting companies turn their attention to IT firms and take advantage of innovations and tools that modern programming languages offer, and make handling financial transactions and financial modeling much easier, especially when it comes to analyzing and processing large volumes of data.

Although the field of finances and financial technologies within this industry is extensive, Python can be especially helpful when it comes to quantitative finance, which requires programming tasks such as:

- Data importation and transformation

- Time series and risk analysis

- Trading and backtesting

- Excel integration

- Data visualization

In short, financial modeling in Python is a method of building a financial model using this programming language. For starters, Python enables programmers to modify and analyze various Excel spreadsheets and automate certain tasks. How is that helpful?

For example, with Python code, you can fully automate the task of copying data from one file (or spreadsheet) to another. In the same way, programmers can accelerate the time-consuming task of searching for errors in the financial files.

If you run a financial company and are interested in how Python is used in finance, take a look at these packages that are mainly used for finance and financial modeling:

- NumPy (it’s a critical open-source package used for scientific and mathematical computing in Python)

- SciPy (comes in handy when a repository consisting of more advanced statistical tools and operations is needed)

- Pandas (this package is designed primarily for financial analysis and model building)

- Statsmodels (this package is built on SciPy and Pandas and implements more advanced testing of different statistical models)

- Quandl (if you work in the financial industry, this is one of your must-have packages. Quandl gives access to an amazing collection of economic, financial, and market data that comes from banks, governments, and other international organizations)

- Matplotlib (provides data visualization, which is particularly important when it comes to financial modeling)

Python for financial analysis

With financial modeling in Python done, we can switch to the subject of Python for financial analysis.

Financial and data analysis is a concept of using programs with sophisticated algorithms and mathematical calculations to collect, process, and analyze financial data.

With financial data processed and analyzed, corporations and financial companies can make more informed decisions. For instance, they can predict future tendencies but also spot and monitor other insightful details and market trends. Such predictions are broadly used in the financial sector, and they are crucial, especially when it comes to building intelligent (fueled with AI and machine learning) risk management systems and assessing the current market situation.

And thanks to various data visualization solutions (like the aforementioned Matplotlib library), you can easily generate charts of the ranging prices and other tendencies within the financial world. Additionally, you are able to apply complex mathematical calculations to construct a context for further predictions and insights that can be used in your financial company.

Python analytics tools

As you already know, Python is extensively used in quantitative finance. That’s because this approach comprises solutions that process and analyze large datasets, financial big data if you will. Some of the aforementioned libraries (such as Pandas) simplify the process of creating sophisticated statistical calculations, and other libraries (like Matplotlib) help with data visualization.

Also, many Python-based solutions utilize machine learning algorithms that are immensely helpful in financial data analytics and predictive analytics, but that’s a subject for another article.

Cryptoccurency market analysis

Did you know that there is a specific Python-based data science ecosystem called Anaconda that helps developers to retrieve cryptocurrency pricing and analyze it or create visualizations? In fact, this application can be very helpful, as every company that trades and sells cryptocurrencies also has to analyze this market in order to obtain insights and predictions.

To sum up, Python is a perfect programming language that’s extensively used in various financial sectors, just to mention banking and fintech, insurance and insurtech, investment management, and financial analysis. With Python, you have all the necessary tools and solutions that help you with market analysis, designing financial models, and working on algorithms reducing risks. At Addepto, we believe that Python is a must-have technology, both for the individual data analysts and large financial organizations.

If you’d like to find out more about financial data analytics, or you are interested in how machine learning and other AI-based tools can help enhance the work of a financial company–we are at your service. Get in touch with the Addepto team today, and let’s do something tremendous together!

References

[1] Md Kamaruzzaman. Top 10 In-Demand programming languages to learn in 2020. Feb 4, 2020. URL: https://towardsdatascience.com/top-10-in-demand-programming-languages-to-learn-in-2020-4462eb7d8d3e. Accessed Feb 15, 2021.

[2] Python. What is Python?. URL: https://docs.python.org/3/faq/general.html#what-is-python. Accessed Feb 15, 2021.

[3] Sarah Feldman. The Most Popular Programming Languages. Jan 8, 2019. URL: https://www.statista.com/chart/16567/popular-programming-languages/. Accessed Feb 15, 2021.

Category: